Micro-cap stocks are highly risky investments, but they also offer the potential for substantial returns if selected carefully

Despite the recent market correction, mutual funds have shown a growing interest in micro-cap stocks. Over the past five months, the Indian equity market has experienced a decline due to a combination of domestic and global factors. Among major indices, the Nifty Microcap 250 Total Return Index (TRI) has dropped by 20 per cent since its peak in September 2024. Similarly, the Nifty 50 TRI, Nifty Midcap 150 TRI, and Nifty Smallcap 250 TRI have fallen by 10 per cent, 18 per cent, and 22 per cent, respectively.

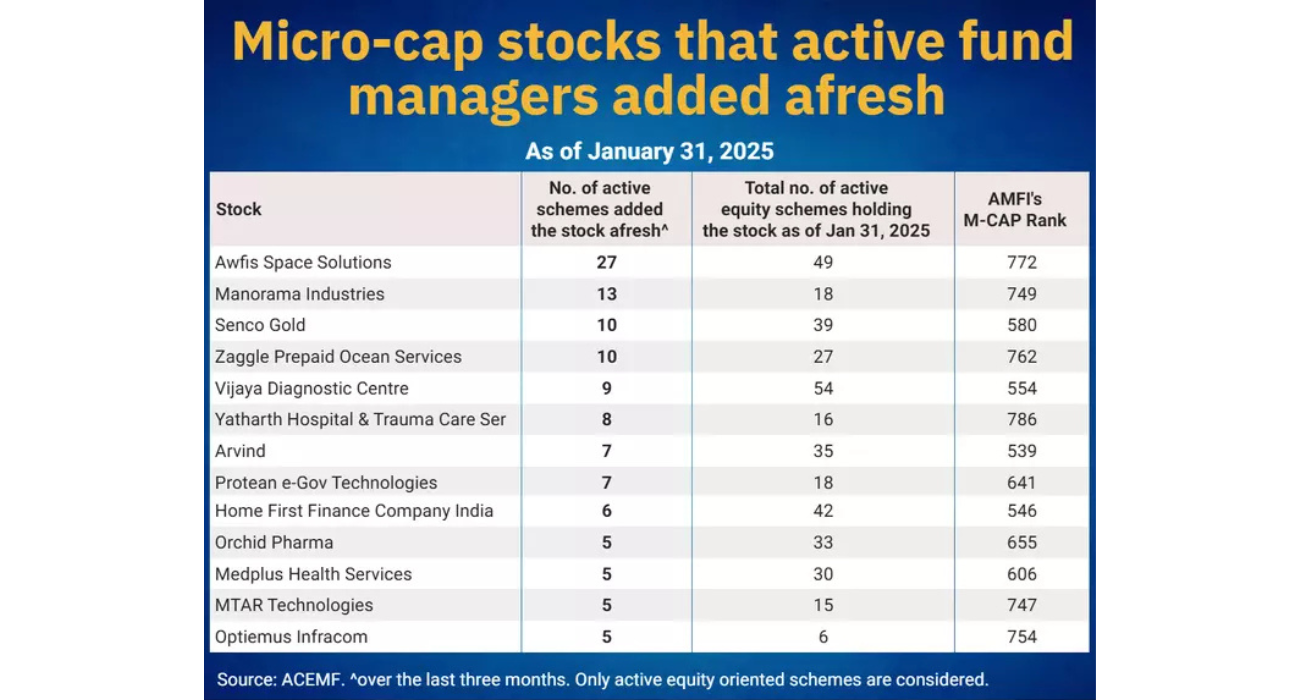

Market volatility, however, presents an opportunity for fund managers to identify good stocks that have undergone notable corrections. Here are the top micro-cap stocks that were newly picked by active mutual fund managers in the last three months. Micro-cap stocks, while inherently risky, have the potential to generate significant returns over the long term. Fund managers use various criteria to select micro-cap stocks that align with their long-term strategy.

Only actively managed equity schemes were considered for the study. Stocks ranked below the 500th spot, as per the Association of Mutual Funds in India’s market capitalisation list, were classified as micro-caps. Portfolio data was as of January 31, 2025. Source: ACEMF.

Source: The Hindu BussinessLine