Today, my father asked his broker to allocate some of my parents’ funds into the BlackRock iShares Bitcoin ETF.

No surprise here, the gentleman advised against it, but did tell my father that it’s his money and he will do as he wishes.

He then sent over an article he wrote in January just a few days after the SEC’s ETF approval, essentially telling his clients that the Bitcoin ETFs exist, however, they do not recommend buying it.

Fair enough, nobody wants to be the financial advisor who told you to buy Bitcoin and then have to explain if the price goes down, after all, their jobs rely on returns and trust.

I do not blame this man at all for that response. It did dawn on me, however, that given all we know now about Bitcoin today, this guy didn’t seem to consider the upside.

How do you explain to your clients that you didn’t think it was a good idea to allocate when Bitcoin ends up doubling in price? 100% is a juicy ROI, in fact, year to date we’re at 150%.

Now, I am aware that Bitcoin is trading 30% lower than it was at all-time highs in Nov of 2021, but if you’re a long-term investor armed with knowledge, you know that bitcoin has done this every 4 years like clockwork. Big parabolic runs up, big drawdowns. If you’re looking at the big picture, the writing is on the wall.

There is no doubt that most financial advisors are unaware of the real underlying technology behind Bitcoin.

They tend to say “speculative” a little more often than I’d like, but again, I don’t blame them; blockchain technology is beyond complex.

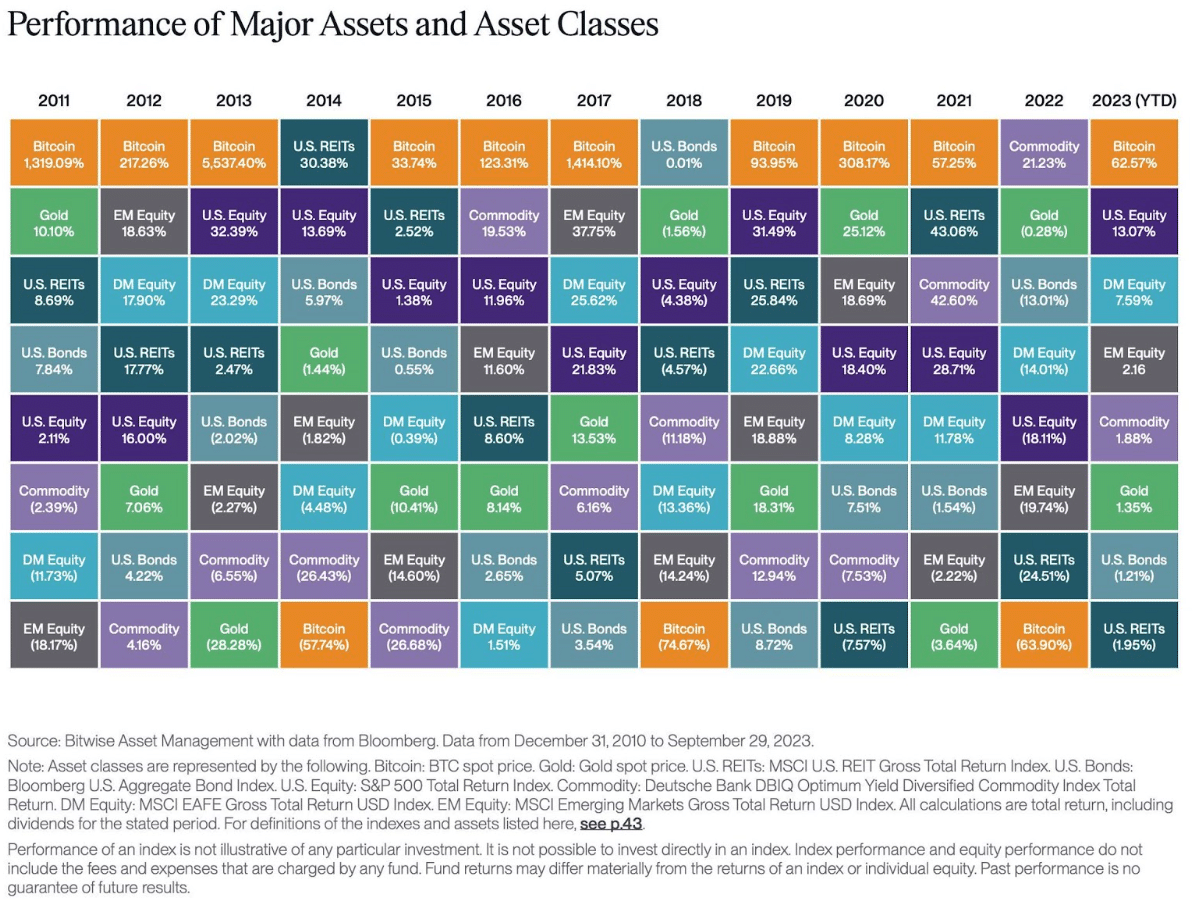

Are they aware of SHA256 hashing algorithms, do they know that new blocks are mined every 10 minutes and only 900 Bitcoins come into existence every day, do they know that number gets cut in half in 70 days, to a mere 450 Bitcoin? Do they know the existing float (available for purchase) on exchanges, or how many coins are circulating at this moment?

Of course not; this is happening behind the scenes in simple code, running on a global decentralized network 24/7/365.

For years, there has been a disconnect between institutions and Bitcoin. For instance, a pension fund can’t just go on Coinbase and buy Bitcoin; there’s tons of red tape and regulation in the way.

They’ve wanted to, we know that they were asking BlackRock, Fidelity, and other investment companies for this ability.

The new ETFs are the pipeline between the institutional client and Bitcoin, and the magnitude and importance of this is understated.

Let’s Get Into Why We Go Up From Here

We’re already up 150% from this time last year. We shook out the bad actors, SBF is gone, the FTX logo was removed from Miami’s flagship stadium.

Three Arrows Capital crashed and burned, as did BlockFi, Celsius, and countless others who flew too close to the sun. We cleaned house, and pushed on regulators and the SEC for clarity, (which by the way we’ve been asking for since 2013).

All the while, behind the scenes there were some massive players who, in the bear market, took some time to dig into the tech, and the law, and began to set up their chess pieces accordingly.

Land of the Giants

Enter BlackRock, Fidelity, Ark, Wisdom Tree and the rest of the gang. Unless you’re living under a rock (little pun intended), these are the companies that run the free world.

Larry Fink’s BlackRock alone has $10 trillion dollars of assets under management.

These guys “DO NOT LOSE” and spent millions in legal fees and research, getting the SEC to finally adhere to the law and approve these ETFs. (Fun fact: Gary Gensler, Chairman of the SEC taught a class on Bitcoin at MIT).

BlackRock is not in the business of buying stocks, they’re in the business of selling, and you can bet that when Larry Fink calls the desks at JPMorgan and tells them to push the iShares Bitcoin ETF, they’re picking up their phones.

The Macro

Today is Feb 7th, 2024, I just watched the S&P hit $4999.89, the all-time high.

Less than a week ago I watched Jerome Powell tell the citizens of the United States that he will not increase interest rates, most analysts have first cuts poised to come in Q2. The United States is at $34 Trillion dollars in national debt. Inflation is out of control, contrary to what the Fed is telling us.

It only takes a simple outing to the grocery store to understand this. The average American knows we’re paying at least 50% higher than we did in 2020 for goods. There’s only one move left to make, Quantitative Easing, they will turn on the money printer once again, my friends. Money spigot on = Bitcoin up.

Supply and Demand

The basic principle of an ETF is: a company buys an underlying asset, sells you shares, and holds the asset for you.

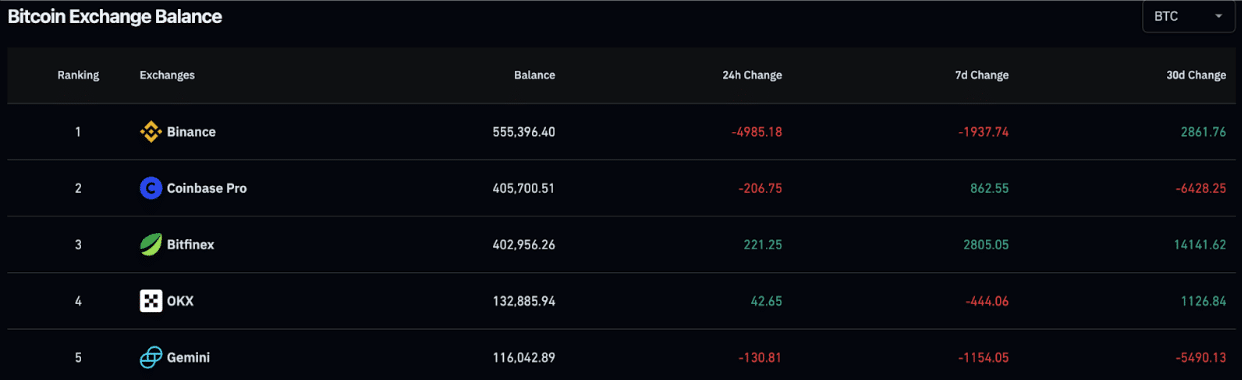

Today alone the 9 Bitcoin ETFs did over $1 Billion in trading volume. The ETFs (which are newer than 30 trading days old) now hold a combined 675,000 Bitcoin, worth about $30,000,000,000.

Daily inflows continue, with new funds that never had access to Bitcoin allocating every day in high numbers, these allocations don’t happen overnight.

This is a snowball effect, so we expect these numbers to rise rapidly. Remember, only 900 new Bitcoin are mined every day, that number drops to 450 in 70 days essentially cutting new supply in half.

The float on exchanges such as Coinbase and Binance is not in millions of coins, but only in the hundreds of thousands. A number that can get drained very easily, especially now with the 9 new ETFs gobbling Bitcoin at an extraordinary rate.

If the new ETFs continue to purchase Bitcoin at the current rate, most of the supply will be dwindled by summer. (And before anyone brings up Grayscale Trust outflows, those were absorbed by the new ETFs).

Aside from the ETFs out there buying coins, lest us not forget we have good ol’ retail.

We all know the moment Bitcoin hits $60,000 our phones will be ringing once again with acquaintances, friends and family asking “how do I buy Bitcoin?”.

Coinbase will once again move to the #1 app in the App Store and media will buzz yet again.

Along with that we have the nation-states that have been sending reps to the recent Bitcoin conferences.

Switzerland is Bitcoin friendly, El Salvador made it legal tender and you certainly don’t want to be buying on the same day the Saudis or Emirates fat finger the buy button. Keep in mind there will only ever be 21M Bitcoin, you can’t print more; these must serve a population of 8 billion people.

Demand has begun, supply only shrinks = number go up.

The Stage is Set

We’ve now got the all-clear from the Securities and Exchange Commission – no more government or regulatory anxiety.

I think we’ve moved past the “magic internet money, this is a scam, you’re an idiot” phase and moved into the “buckle up, Wall Street is here” phase.

Which brings me back to my original point: get off zero percent.

Everyone has a risk tolerance, nobody wants to be wrong and nobody wants to lose, but if you had to bet on what happens first, Bitcoin goes to zero or Bitcoin goes to $100,000, which way do you think this goes? So, even if it’s 1% of your portfolio, allocate to one of the new Bitcoin ETFs and get off zero.

Richard Levin is Vice President of Cryptonews.com

Source: cryptonews.com